In just one year, the crypto market cap hit $3 trillion, the SEC approved the first bitcoin ETF, and the NFT craze pushed digital doodles to millions of dollars in value, making cryptocurrency officially into the mainstream. So what shows that crypto has reached a record year? Here are six metrics that defined crypto in 2021 and what they mean for the coming year

11%

Estimates suggest that Bitcoin market cap hit $11 trillion in gold at the height of its bull run on November 10, 2021. That day, Bitcoin hit an all-time high of $68,721, up 120% and up nearly $3 billion market capitalization. Three years ago, Bitcoin’s total market cap amounted to approximately 2.8% gold, but it’s still not the best performing cryptocurrency until 2021. Ethereum – a multipurpose platform that can handle any type of transaction, has grown by 443% since last year and it is even beaten by many known competitors such as decentralized finance (DeFi) tokens and impossibility tokens. alternative (NFT).

This shows: while Bitcoin’s ‘digital gold’ narrative has found an easily accessible audience, as its rise coincides with record inflation, it still trades wildly which makes it significantly untouchable for anyone seeking sleep-well-at-night safety in their asset purchases.

123.02

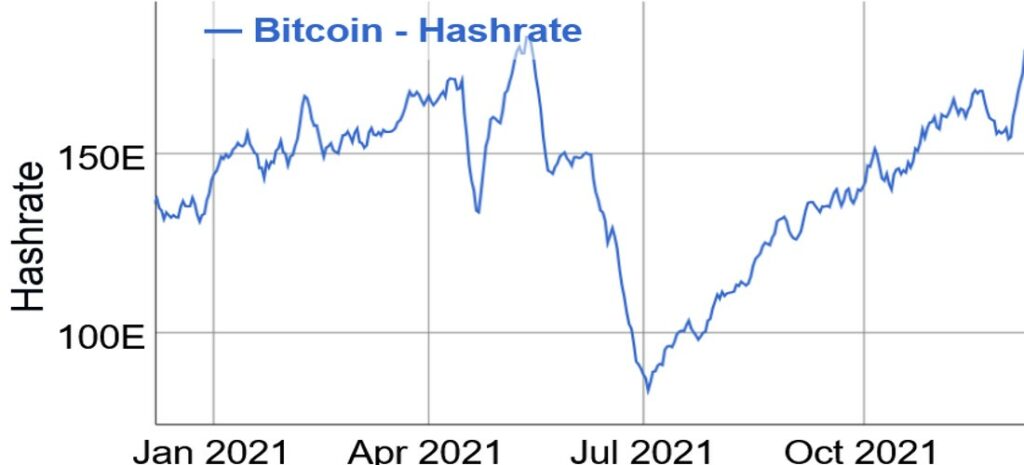

The estimated annual energy consumption of Bitcoin miners, 123.02 terawatt-hours (TW/h) – a measure of electrical energy. According to the Cambridge University Bitcoin Electricity Consumption Index, which maintains a model used to track electricity usage, energy levels have reached approximately the same amount as Argentina, Columbia, Norway, Sweden and Ukraine use in a given year. As Bitcoin rallied this year, the hash rate increased dramatically to establish multiple all-time highs in the spring.

As you can see in the chart below, the hash rate experienced a significant drop after China abandoned their entire mining industry over the summer. However, the network has regained those losses and is poised for further growth. Also, the top miners are planning to add hundreds of thousands of new machines by 2022, so this is just the beginning. Plus, Bitcoin’s carbon footprint is bound to increase as key parties refuse to switch to more energy-friendly alternatives due to concerns about weaker security or network centralization. , which is crucial to Bitcoin’s value proposition. In many cases, the industry response has been to seek out renewable sources of electricity or buy carbon offsets.

Bitcoin’s hash rate quickly recovered from the China ban (cryptonews.com)

$233,276

Founded in 2017 and 2021 respectively, CryptoPunks and Bored Ape Yacht Club monkeys are “pfp” collections, meaning owners love to display their punk or ape as their profile picture. You can easily see 1 in 10,000 CryptoPunks or BAYC apes available as a Twitter avatar, a Gmail icon, a Facebook profile picture or even a LinkedIn headshot. In the NFT world, the “floor price” for the NFT is exactly what it sounds like: the lowest price to buy that asset class. Most sales for one of the oldest and most precious NFT collectibles, CryptoPunks, also surpass this number. The floor price is probably even higher than digital artist Beeple selling a piece of art for a staggering $69 million.

In 2021, NFT becomes more popular as prominent exchanges such as Coinbase, FTX, Crypto.com and Blockchain.com launch their own marketplace. Showing overall success will also require finding ways to make them more accessible to everyday investors.

$27,000,000,000

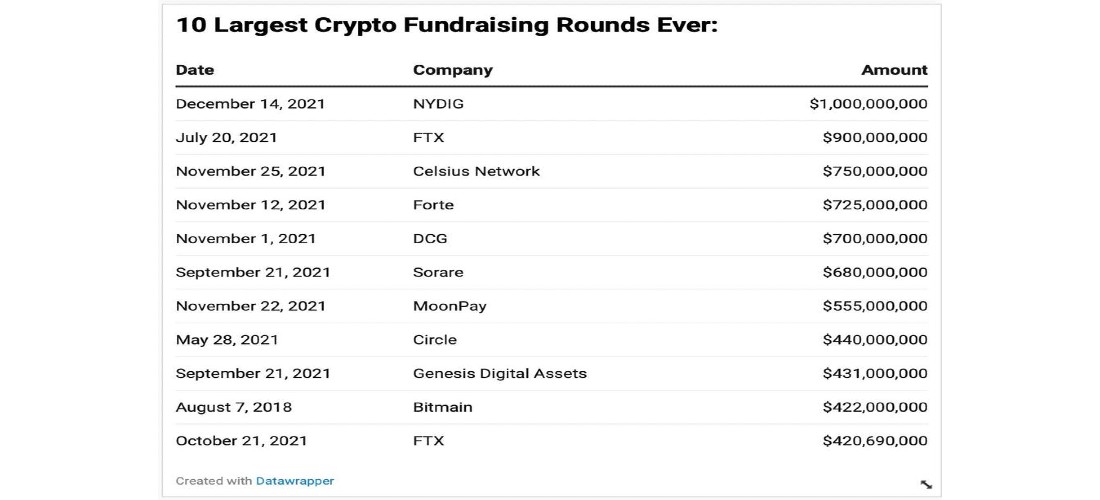

This is the total amount of funding that crypto companies have raised from venture capitalists in 2021, more than the previous 10 years combined. Additionally, nearly all of this year’s 10 biggest investment rounds, which brought in $6.3 billion, were the industry’s biggest-ever round at the close. The two biggest companies are electronics provider NYDIG, which raised $1 billion this month, and a Series B round of $900 million. Just three months later, the Bahamas-based company raised an additional $420,690,000, boosting its valuation 20 times — from $1.2 billion just a year ago to a whopping $25 billion. This is perhaps one of the most striking examples of the tremendous growth over the past 12 months. The rapid success of FTX has also made 29-year-old founder Sam Bankman-Fried the richest person under the age of 30 on the planet with a fortune of $26.5 billion.

Furthermore, the company’s appetite for joint ventures is growing. Last month, crypto-focused investment firm Paradigm announced a $2.5 billion fund, surpassing Andreesen Horowitz III’s $2.2 billion crypto fund.

$12 billion

This is the estimated amount of capital raised in 2021 to build Metaverse – a virtual reality layer for the internet. Led by Epic Games, which raised $1 billion earlier in the year to ensure its games aren’t displaced by competitors built on blockchain. According to venture capital data site Crunchbase, more than 700 Metaverse-related deals closed during the year in areas as diverse as online games and augmented reality. In April, Forbes sold the first NFT magazine cover for $333,333. Cover page Tyler and Cameron Winklevoss – Master of the Metaverse, raised $400 million to build their crypto exchange and invest in several Metaverse-related projects.

Metaverse is sure to become one of the hottest topics in 2022, as Google searches for this term increase by 1,000% in the past few months and prominent tokens attached like AXS, MANA, and SAND will rise. record chief. Keanu Reeves expressed the feelings of many cryptographers when Facebook announced the rebranding of its Meta, in an interview with The Verge, he said: “Can we just not have metaverse be like invented by Facebook.”

10 Largest Crypto Fundraising Rounds Ever DATAWRAPPER

88%

The spike in open interest (OI) shows the number of unsettled contracts at CME, so far in Q4 of this year. Despite the continuation of the 2020 bull cycle through early 2021, open interest turned sour in the spring as institutions eased some of their bets. The launch of ether futures and then micro-bitcoin futures did little to boost new OI growth. Nine months from 2021, crypto open interest has dropped 14%.

But then in Q4, the dollar value of CME crypto futures contracts reached ~$4.7 billion per day in October 2021, up 783% year-on-year and temporarily making CME an exchange. The world’s largest cryptocurrency derivatives exchange. Following the launch of 3 bitcoin ETFs, CME crypto Oi is now up 12% from a 2020 record, and the dollar value of these contracts is up 351% to $5 billion. With this momentum, the CME should soar in 2022. However, it is expecting a much more crowded competitive landscape in 2021 and some of its ‘exclusive’ positions could be diminished if the SEC approves. agreed to a long-awaited spot ETF next year.

Although 2021 is the year we are heavily affected by the epidemic, the development of cryptocurrencies is a glimmer of light this year. Following this growth momentum, the cryptocurrency market will grow to tens of trillions of dollars in the near future.

>> View more: Amazon And Apple Both Fall Short Of Earnings Expectations! And what’s causing them?

>> View more: What Is The ‘Metaverse’ And What Does It Have To Do With Facebook?

How do you think about this article? Please share it with us via the comment section below.

PRIMUS – TOP MANAGEMENT JOBS ONLY