In the modern economy, e-commerce has provided numerous entities with massive opportunities for expansion on a larger scale and offered prospects for rapid development. More companies have combined selling their products on the Internet. Currently, Southeast Asia is considered to be one of the world’s fastest-growing regions in digital commerce.

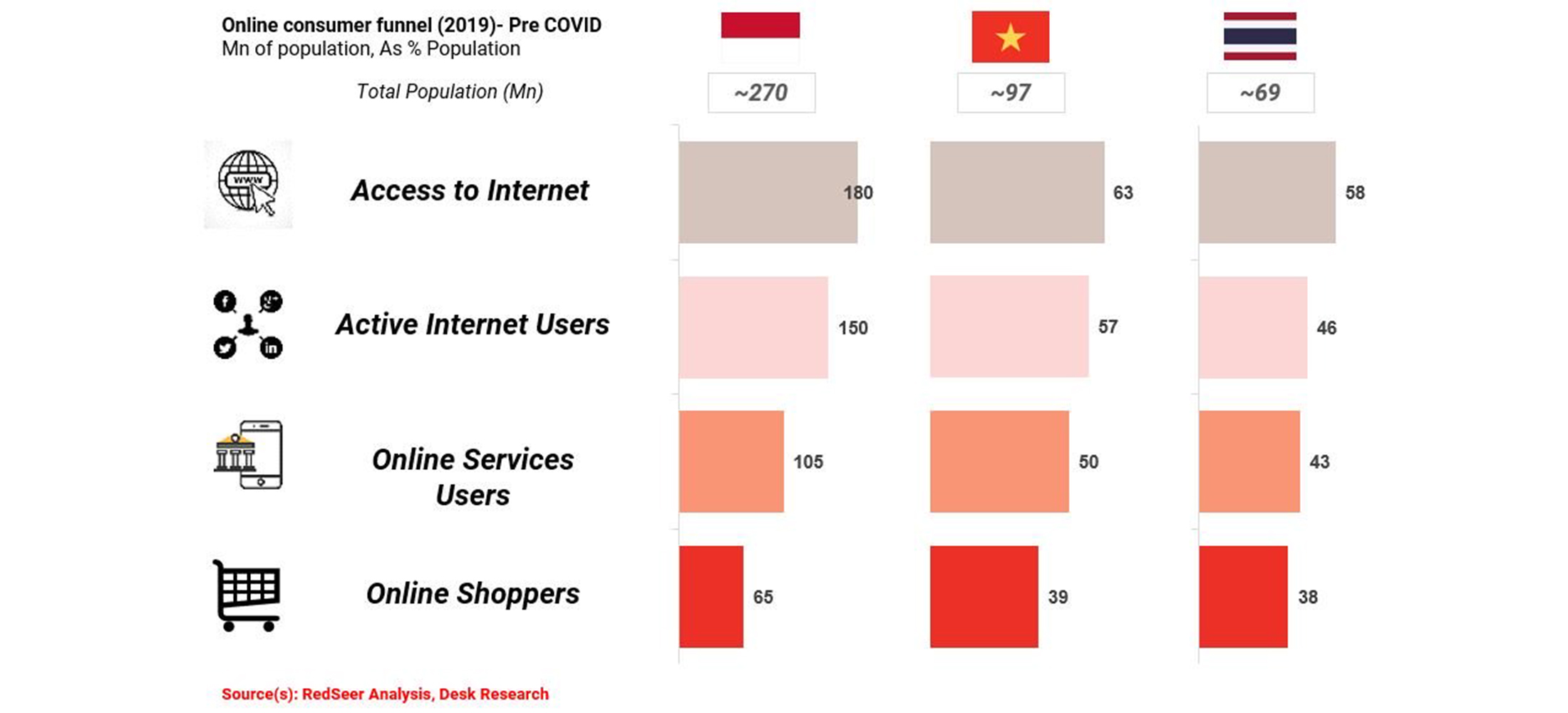

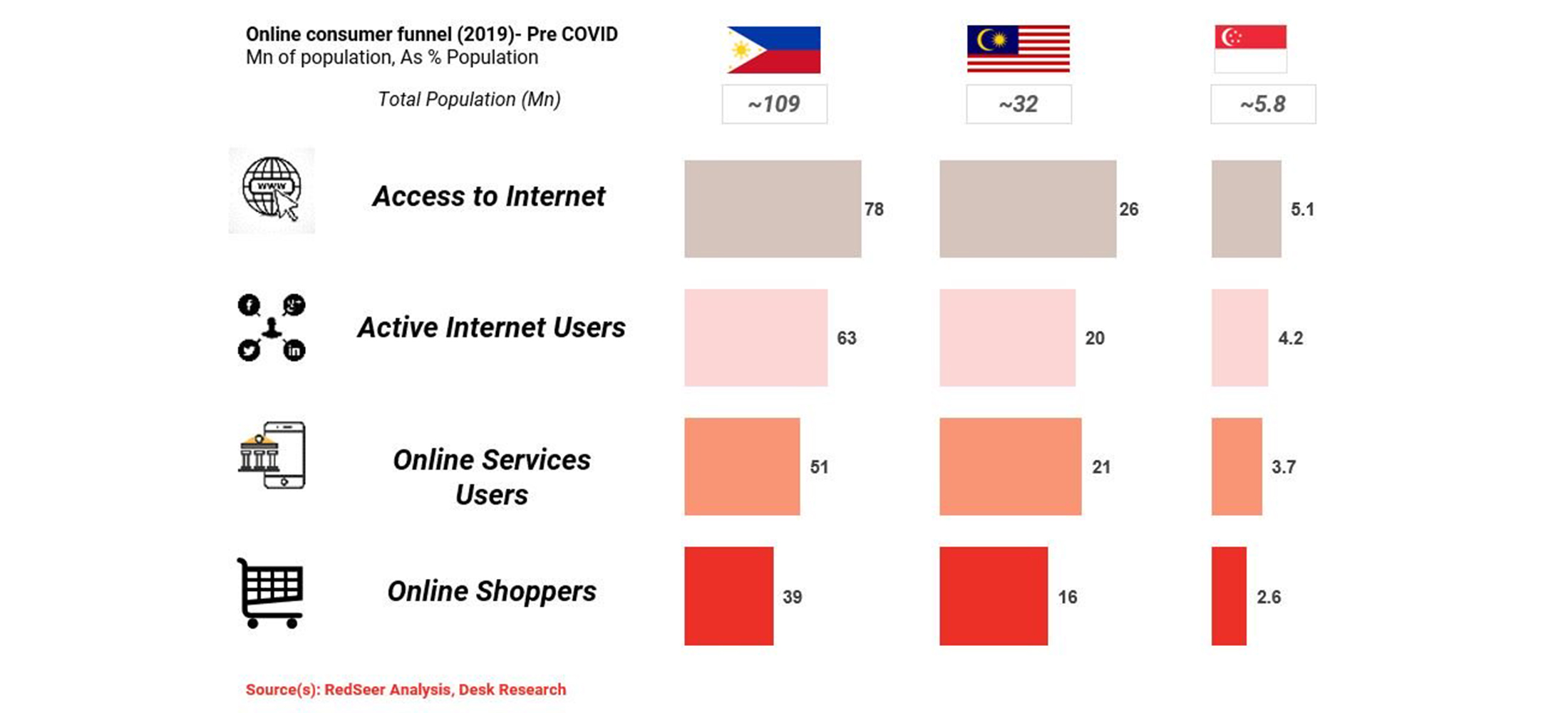

The ASEAN region is the 3rd largest population in the world, where internet connectivity is increasingly getting popular. Hundreds of millions of people across Southeast Asia already shop online and the number is still escalating. With the continuous rise of smartphones, internet penetration, and other factors, social commerce, and e-logistic are expected to flourish rapidly in the region.

The potential future growth

One reason online shopping has been so trendy in the region is the remarkable growing number of middle-class consumers at a relatively young age range. The majority of these customers are active users of online platforms with a high average daily usage, making Southeast Asia the goldfield for e-commerce and e-logistic. Consumers in ASEAN will be spending on digital platforms three times as much in 2025 according to a new study from Facebook and Bain & Company.

Statista reported that the ASEAN e-commerce market size will reach 22 billion USD at the end of 2020 and is forecasted to increase to 88 billion USD in 2025, making up more than 40% of the total worth of the region’s internet economy and Internet users will double to 600 million. Therefore, online commerce companies in Southeast Asia operating are looking forward to great advancement in the long-term.

The ASEAN e-commerce market is also propelled by local start-ups such as Go-Jek, Grab, NinjaVan, Deliveree, and Chillibeli. These players try to make online shopping smoother by providing logistics services such as fulfillment, delivery, and solving the last-mile logistics problem. Unquestionably, their activities and investments contribute to improving logistics connectivity and, consequently, can lead to cost reductions and improved service quality.

COVID has brought more opportunities to social commerce

Government-enforced lockdown measures have provided an unexpected boost for niche e-commerce platforms that consumers may never have visited otherwise. Many sellers have shifted to online channels to expand their reach to more buyers and maintain their businesses. Southeast Asia nations are large in vendors, take Jakatar with over 60,000 for instance, and these vendors are rushing to complete their online stores on major e-commerce platforms to adapt to the “new normal”. Even big shopping malls will soon be available in the Internet environment. Hence, Unemployed people during this period are also trying to leverage social commerce as a way to generate some quick income while the economy gets back on track.

The remaining challenges

Though the coming future of e-commerce in ASEAN is full of opportunities there are certain obstacles to overcome. The efficiency of digital commerce is determined by logistic connectivity and data configuration.

Transport services, the critical aspect of e-commerce logistics, must be cost-effective, reliable, and quick. Roads are amongst the most frequently used modes of transport, particularly, and fragmented roads are some of ASEAN’s major concerns. The development of highway systems has lagged although the number of vehicles has doubled over several years in countries such as Indonesia and VietNam, which result in unwanted long delivery time. When the delivery takes longer, due to low-speed transportation and frequent traffic jams, operations cost gets higher because of the compensation for longer working hours and various informal charges. In general, the ASEAN logistics industry is still fragmented and immature compared to those in the European or the United States markets.

Another problem is that data about e-commerce logistics infrastructure in the ASEAN countries is lacking, incomplete, or obsolete, particularly about the number of enterprises, their turnover, market structure, performance, costs, and employment. Data banks in most ASEAN member countries are not centralized and the methods used to collect and present data are not standardized, which makes data comparisons extremely difficult. Limited data causes difficulties in identifying and analyzing existing issues in logistic flow along with forecasting demands to come up with better sales strategies.

Improvements to further develop e-commerce in ASEAN

The quality of road infrastructure in Southeast Asia is still uneven. Individual countries must harmonize and standardize their road systems. Not only paved roads but also multi-lane dual carriageways and highway networks are necessary to efficiently accelerate e-commerce development. The greatest problem is in Cambodia, Lao, Myanmar, and Viet Nam, where road infrastructure highly lags behind that of other ASEAN members. These nations must not only invest in road enhancement but also solve traffic jams by using articulated trucks and enforcing roadworthiness certificates.

As for the improvement of data configuration, ASEAN should create systems that allow independent companies to cooperate and enable different information systems to safely exchange data within a predefined structure and mutually use this data to further create information. Many risks can be reduced by eliminating human error and putting in place adequate quality assurance processes. One solution, which improves interoperability, is to use a single, common label on parcels, based on open global standards.

Conclusion

ASEAN could potentially become one of the fastest-growing e-commerce markets. The region has a relatively young population of 640 million, who use social media actively and purchase more and more products on the Internet along with new players constantly innovating the business model. However, Southeast Asia’s e-commerce is still in its infancy. To ensure long-term enhancement, e-commerce logistics services must become more efficient, and bottlenecks must be removed.

According to Forbes

————–

How do you think about this article? Please share your feedback with us via the comment section below.

PRIMUS – TOP MANAGEMENT JOBS ONLY